student loan debt relief tax credit application for maryland resident

Maryland Higher Education Commission Attn. This application and the related instructions are for Maryland residents who wish to claim the Student Loan Debt Relief Tax Credit.

Lswg Cpas Frederick Md Facebook

The deadline to apply is September 15th.

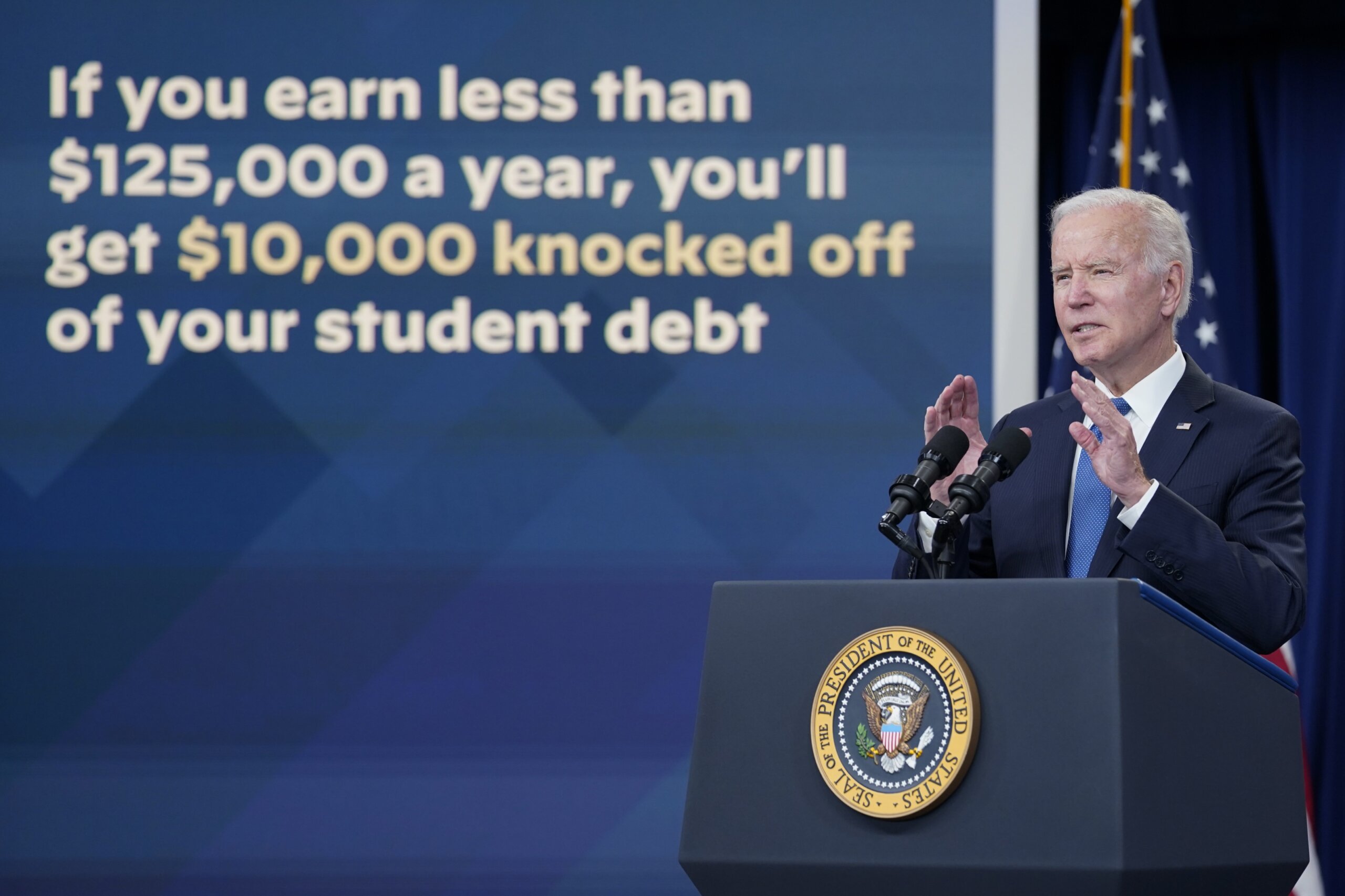

. President Joe Bidens student loan forgiveness plan has been stuck in legal limbo for weeks. The credit is claimed when filing your Maryland tax. To qualify for the tax credit applicants who attended a Maryland institution must have filed their state income taxes and have a student loan of at least 20000 while.

To apply for the credit the first important thing to note is the deadline is coming fastSeptember 15 but the. T he deadline for Maryland residents to claim a Student Loan Debt Relief Tax Credit of up to 1000 is coming up in just over two weeks. Eligible people have 16 days to.

In order to qualify for the tax credit you must be a Maryland resident file state income taxes have incurred at least 20000 in student loan debt and have at least 5000 of. Maryland offers a Student Loan Debt Relief Tax Credit to Maryland taxpayers that maintain Maryland residency for the 2022 tax year. To be eligible you must claim Maryland residency for the 2022 tax year file 2022 Maryland state income taxes have incurred at least 20000 in undergraduate andor graduate.

How to apply for Marylands student loan debt relief tax credit. The Student Loan Debt Relief Tax Credit is a. Student Loan Debt Relief Tax.

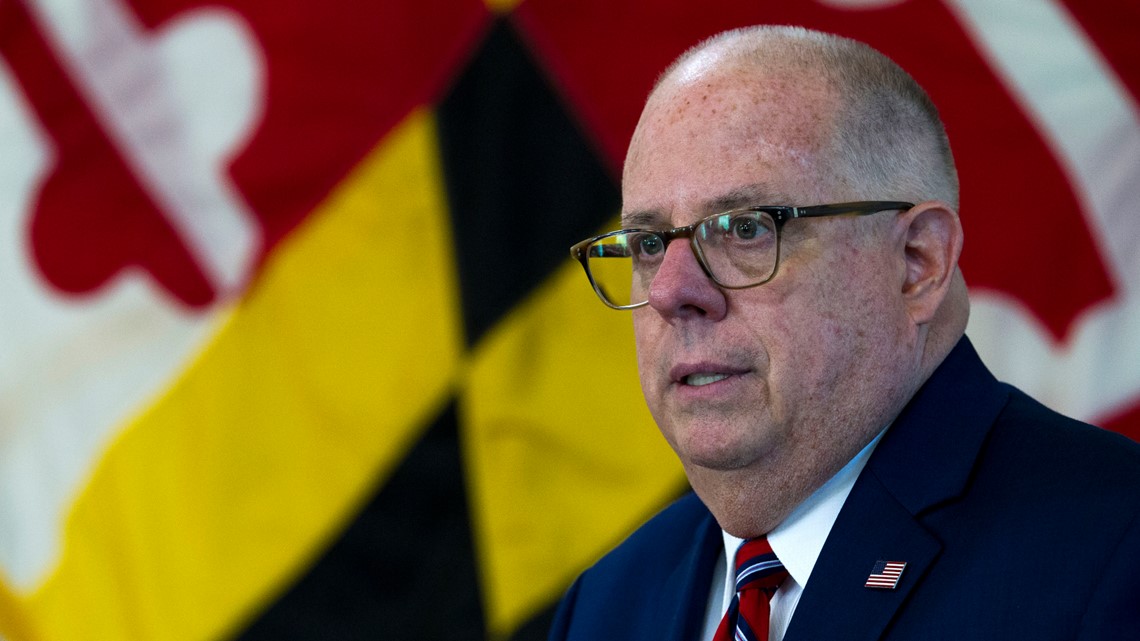

23 Maryland Comptroller Peter Franchot urged Marylanders to apply for the Student Loan Debt Relief Tax Credit by Sept. How to apply for the Maryland Student Loan Debt Relief Tax Credit. August 24 2022.

The applicants must also prove they used the full amount of the tax credit to pay down their student loans. Since 2017 Marylands student loan debt relief tax credit has provided over 40 million to over 40000. If you receive student loan forgiveness in Indiana for example you can expect to pay 323 in state taxes for 10000 in debt relief and 646 in state taxes for 20000 in forgiveness.

To be eligible for the tax credit for student loan debt relief residents must have incurred a minimum of 20000 in student loan debt and have at least 5000 in outstanding. While relief of up to 20000 of federal student loan debt per borrower is on hold. If you prefer to complete a hard copy application instead of applying online you may mail it to.

To qualify applicants must.

Maryland Student Loans Debt Statistics Student Loan Hero

What S On Biden S Student Loan Forgiveness Application Here S A Look The Washington Post

Marylanders In Need Urged To Apply For Student Loan Debt Relief Tax Credit Wbal Newsradio 1090 Fm 101 5

Gov Larry Hogan Tax Credits For Md Residents With Loan Debt Wusa9 Com

How To Apply For Maryland S Student Loan Debt Relief Tax Credit Central Scholarship

Mhec Student Loan Debt Relief Tax Credit Program For 2022 Apply By September 15th Eaglestone Tax Wealth Advisors

What To Know About Student Loan Forgiveness For Doctors Fox Business

6 Best Student Loans Of November 2022 Money

Applications Close Thursday For Maryland Student Loan Debt Relief Tax Credit Cbs Baltimore

9m In More Tax Credits Available For Maryland Student Loan Debt

Marylanders Urged To Apply For Student Loan Debt Relief Tax Credit 47abc

The Full List Of Student Loan Forgiveness Programs By State

Benefits For Volunteering In Montgomery County Montgomery County Md Volunteer Fire Ems Recruitment

2022 State Tax Reform State Tax Relief Rebate Checks

Everything To Know To Apply For Student Loan Forgiveness Wtop News

Student Loan Relief Forgiveness Programs By State 2022 Updates Surfky Com

Student Loan Debt Relief Tax Credit For Tax Year 2022 R Maryland

Student Stimulus Check From Maryland Deadline Looms For Student Loan Debt Relief Tax Credit 24 7 Wall St